Fica Medicare Percentage 2024 Chart. Federal payroll tax that plays a critical role in funding social security and medicare. The federal insurance contributions act (fica) tax on wages remains at 7.65% for both the employee and the employer.

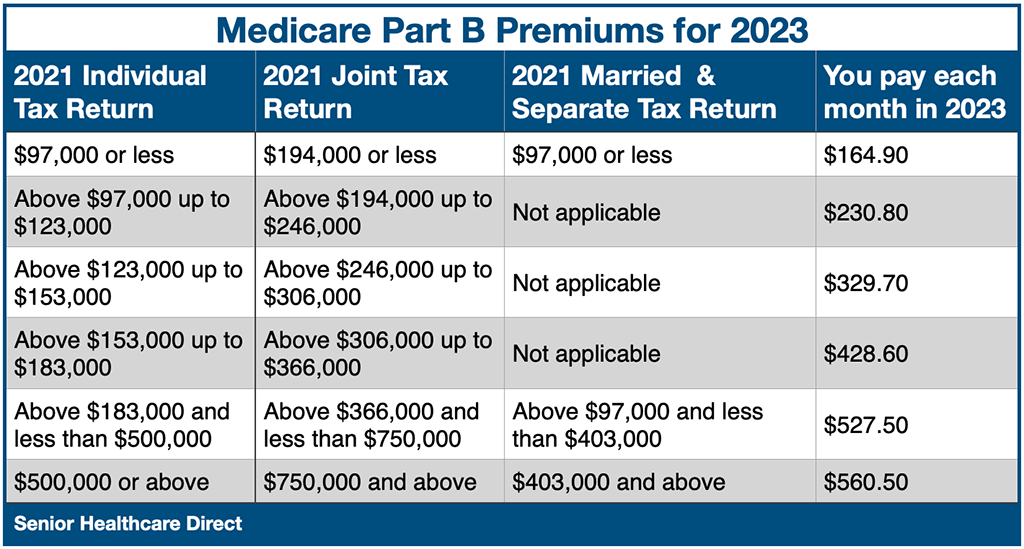

The annual deductible for all. The social security wage base limit is.

The Rate Is For Both Employees And Employers, According To The Internal Revenue Code.

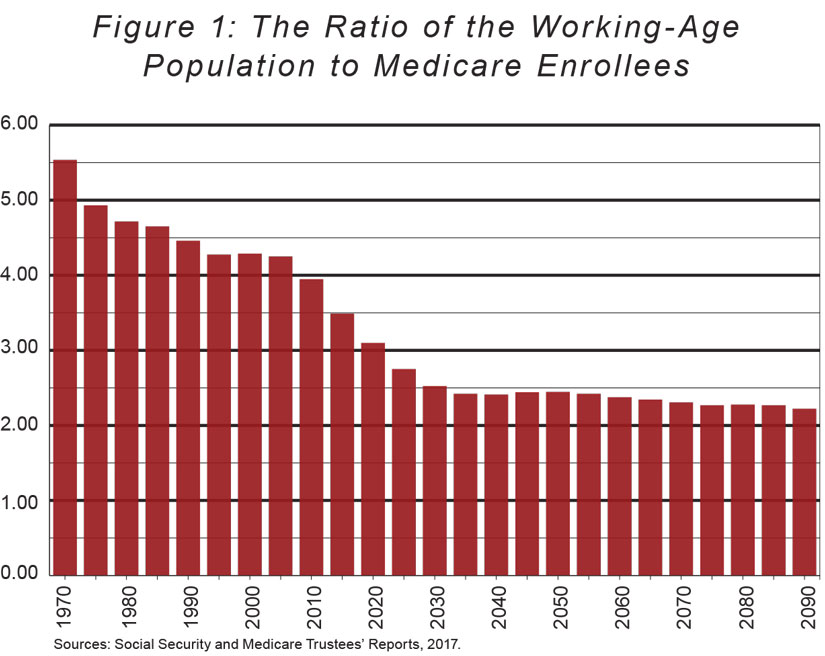

For medicare's hospital insurance (hi) program, the taxable maximum was the same as that for the.

The Additional Medicare Tax Of.9% Applies To Earned.

The federal insurance contributions act, commonly known as fica, is a u.s.

Fica Medicare Percentage 2024 Chart Images References :

Source: phaidrawtracy.pages.dev

Source: phaidrawtracy.pages.dev

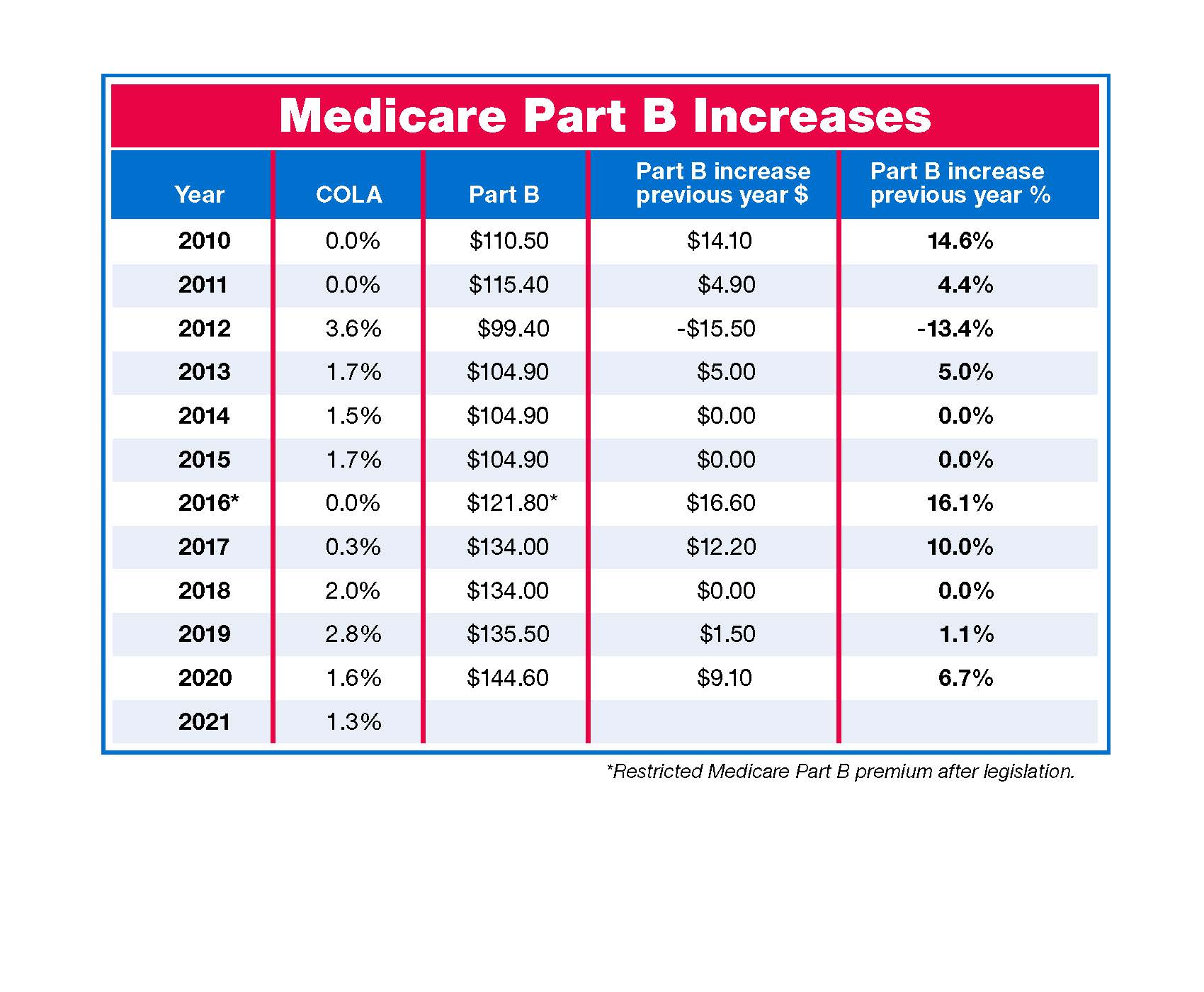

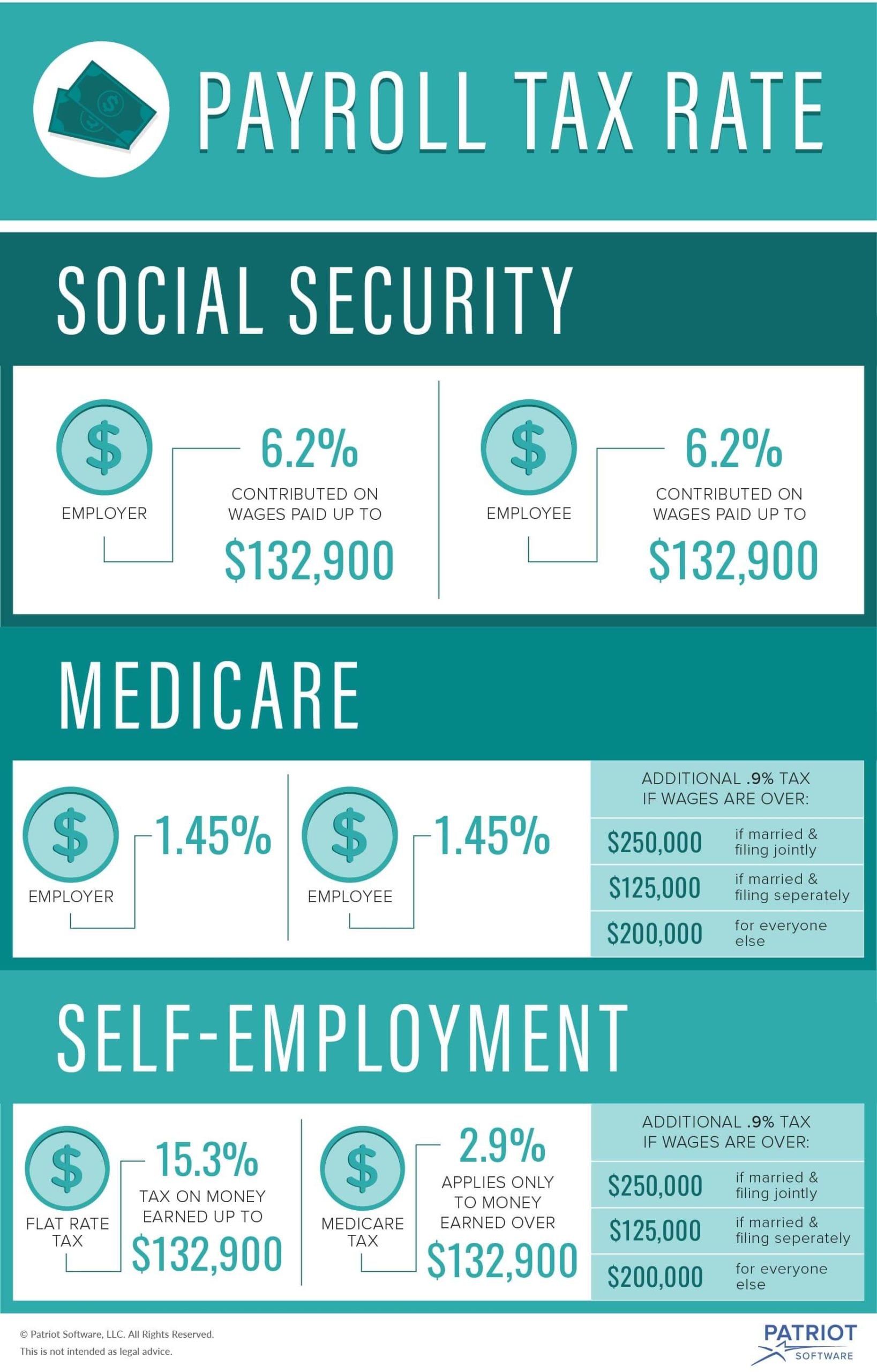

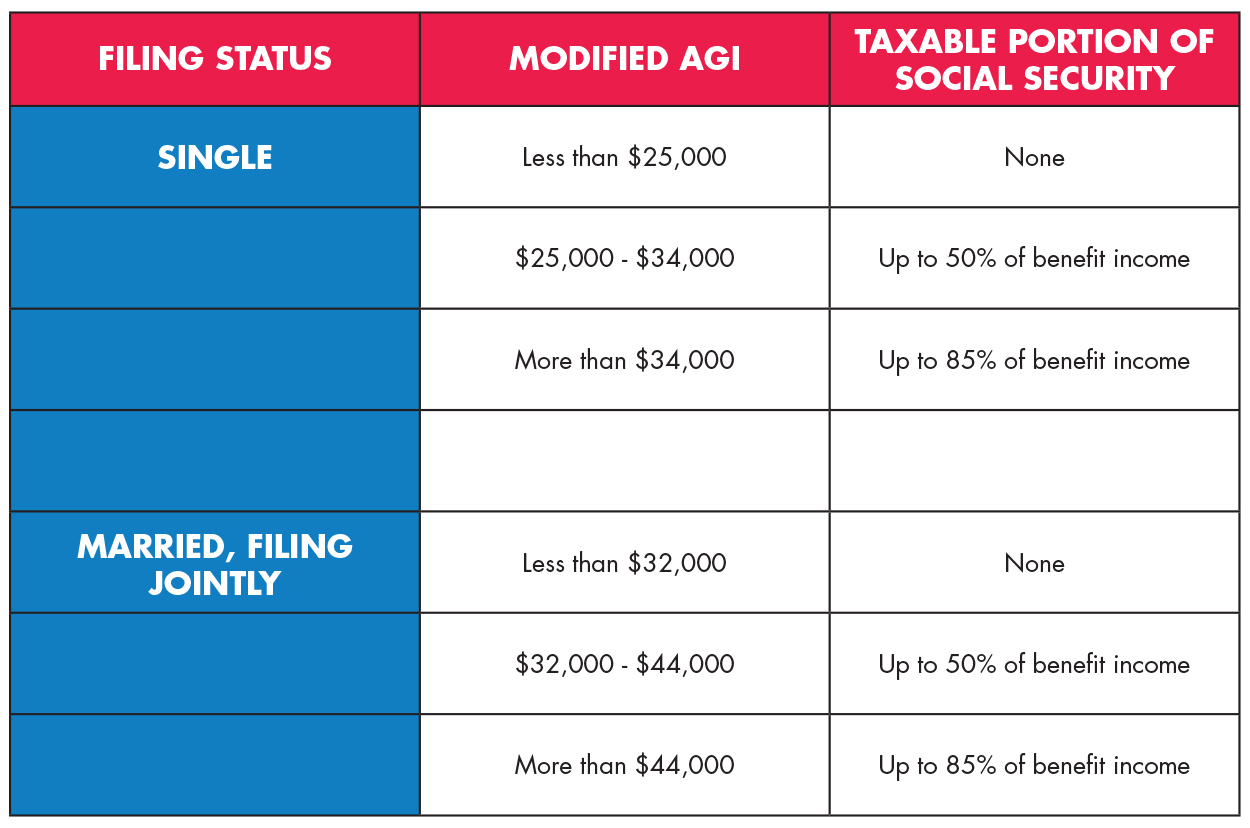

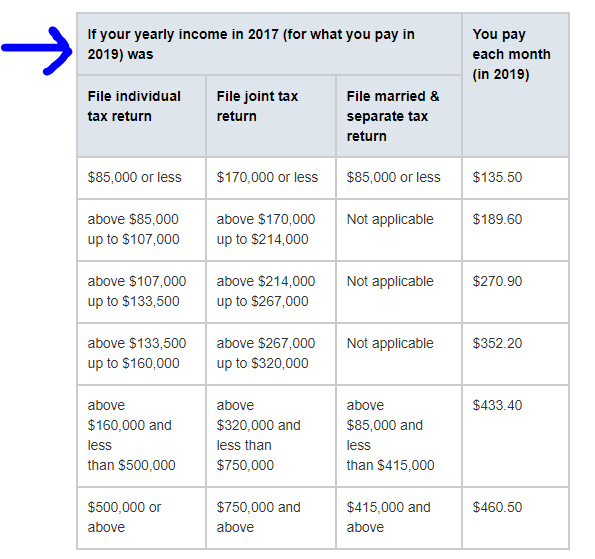

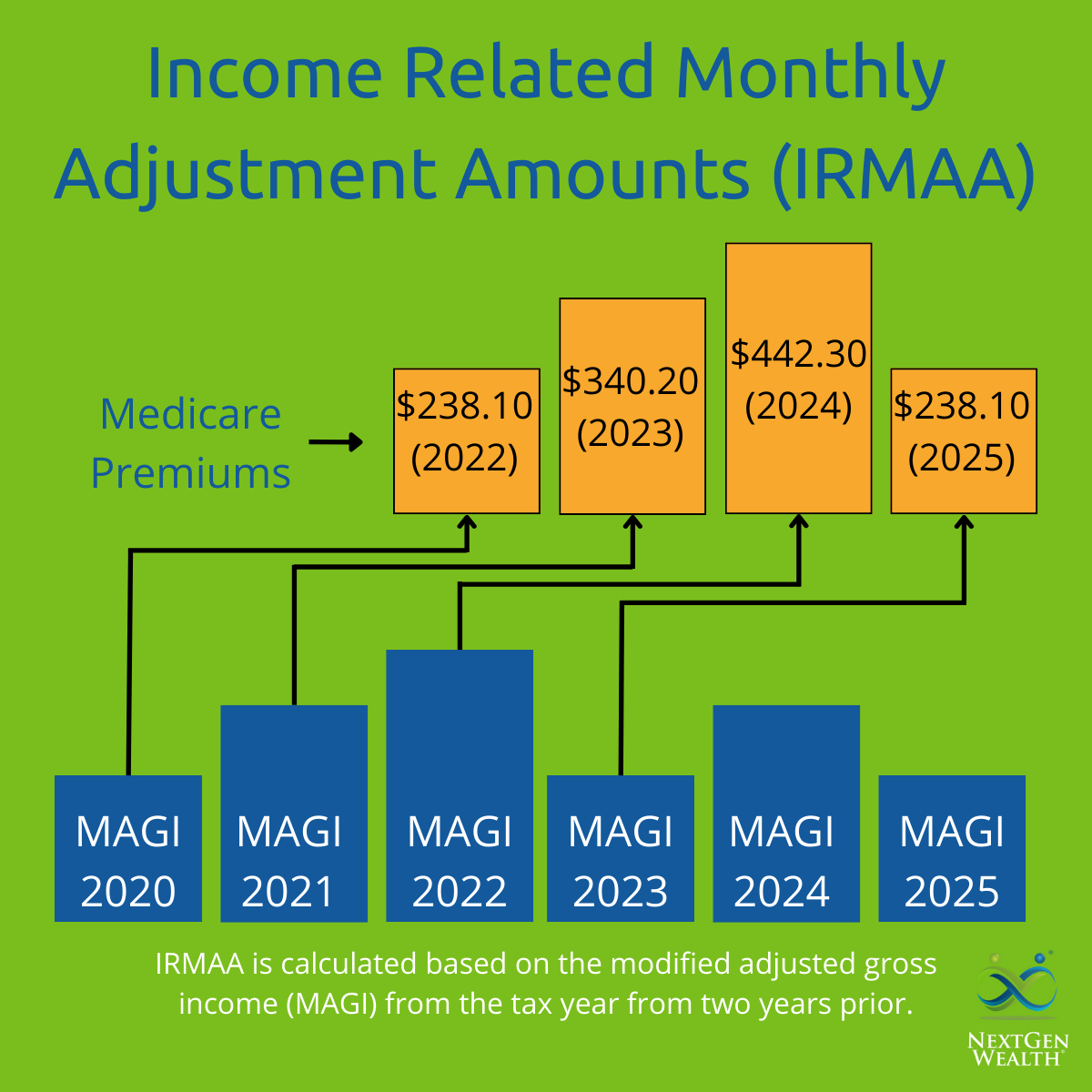

What Are Medicare Costs For 2024 Kevyn Merilyn, The annual deductible for all. The fica tax rate, which is the combined social security rate of 6.2 percent and the medicare rate of 1.45 percent, remains 7.65 percent for 2024 (or 8.55 percent.

Source: www.pinterest.com

Source: www.pinterest.com

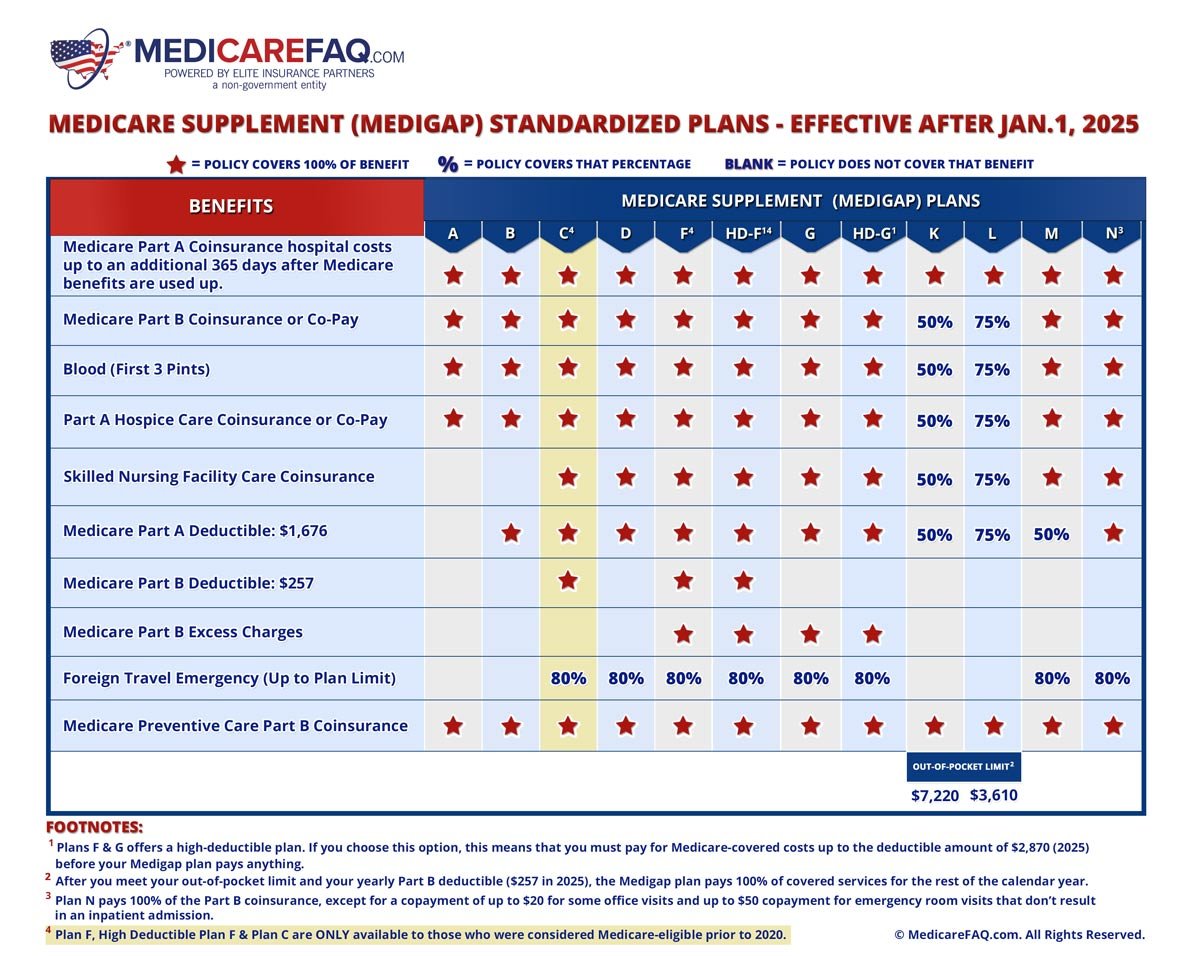

Understanding FICA, Social Security, and Medicare Taxes, You’re typically responsible for paying half of this amount (1.45%), and your employer is responsible for the other half. Fica taxes include both social security and medicare taxes.

Source: ireneqoralla.pages.dev

Source: ireneqoralla.pages.dev

Medicare Tax Calculator 2024 Myrah Tiphany, 6.2% for the employee plus 6.2% for the employer; 1.45% for both the employer and the employee.

Source: adeyqingaberg.pages.dev

Source: adeyqingaberg.pages.dev

2024 Max Fica Wages Davita Lavinia, The federal insurance contributions act (fica) tax on wages remains at 7.65% for both the employee and the employer. The rate of social security tax on taxable wages is 6.2% each for the employer and employee.

Source: medicare-faqs.com

Source: medicare-faqs.com

What Are Fica And Medicare Deductions, Federal payroll tax that plays a critical role in funding social security and medicare. The rate is for both employees and employers, according to the internal revenue code.

Source: juliennewjeana.pages.dev

Source: juliennewjeana.pages.dev

Medicare Limits 2024 For Seniors Gaye Pearle, 29 rows tax rates for each social security trust fund. The medicare tax rate for 2024 remains at 1.45% of all covered earnings for employers and employees.

Source: rosaliewviki.pages.dev

Source: rosaliewviki.pages.dev

2024 Pay Tables Sari Winnah, The medicare tax rate in 2021 and 2022 is 1.45% for both the employer and the employee. You’re typically responsible for paying half of this amount (1.45%), and your employer is responsible for the other half.

Source: medicare-faqs.com

Source: medicare-faqs.com

How To Check Fica Medicare Refund, Federal payroll tax rates for 2024 are: The social security wage base limit is.

Source: henrywest.z19.web.core.windows.net

Source: henrywest.z19.web.core.windows.net

Medicare Part B Premium 2024 Cost Chart, The second half of fica is the medicare tax. Federal payroll tax rates for 2024 are:

Source: rhodiawhetti.pages.dev

Source: rhodiawhetti.pages.dev

Medicare Advantage Plans 2024 Cost Chart Sella Daniella, The additional medicare tax of.9% applies to earned. The federal insurance contributions act, commonly known as fica, is a u.s.

To Calculate Employee's Medicare Tax:

Federal payroll tax that plays a critical role in funding social security and medicare.

29 Rows Tax Rates For Each Social Security Trust Fund.

The rate of social security tax on taxable wages is 6.2% each for the employer and employee.